Application For Tax Clearance Certificate - Application For A Tax Clearance Certificate Tc1 - Tax Walls / Applicant name (or firm making this application).

Application For Tax Clearance Certificate - Application For A Tax Clearance Certificate Tc1 - Tax Walls / Applicant name (or firm making this application).. The following are guidelines for the submission of the completed application form for the. Use form iht30 to apply for a clearance certificate, showing you have paid all the inheritance tax due. Reference number(s) of the earlier applications(s( for clearance certificate(s): Applications may be filed by post either to the inspectorate for cdp or to the fts of russia. Certificates of fixed deposits b.

All content is public domain unless otherwise stated. You may obtain a duplicate copy of a clearance certificate from the seller or apply to us using this form. Sworn application form (individual taxpayers).more. Application for tax clearance certificate. I declare that the information given above in true and accurate to the best of my 6.

Use form iht30 to apply for a clearance certificate, showing you have paid all the inheritance tax due.

Applications for tax residency certificates (with all required enclosures) are considered within 30 calendar days upon delivery to the inspectorate for cdp. Application form for tax clearance certificate. You must complete an application for tax clearance form and submit it to one of the inland revenue offices listed in. Tax clearance to participate in the criminal justice legal aid scheme if you are applying for tax clearance in your own name and you are an employee (paying tax i have included all information relevant to this application. .clearance certificate application form to notify us foreign resident capital gains withholding doesn't need to it provides the details of vendors so we can establish their tax residency status. All content is public domain unless otherwise stated. A tax clearance certificate is confirmation from revenue that your tax affairs are in order at the date of issue. Tax clearance certificate usually covers a period of three years in arrears. Certificates of fixed deposits b. If your application was accepted, you should see a green indicator stating compliance under compliance. You really don't have to go to sars if you can do it online and in this video, i show. Sample letter of application for tax clearance certificate. A manual application form must be submitted for each request.

Use form iht30 to apply for a clearance certificate, showing you have paid all the inheritance tax due. You must complete an application for tax clearance form and submit it to one of the inland revenue offices listed in. A ⭐tax clearance certificate⭐ is one of the most important documents for any business. All content is public domain unless otherwise stated. Sample letter of application for tax clearance certificate.

In order to make the city tax clearance process simpler for you, there have been changes made in how the new york city department of finance issues whether you walk or mail in your new york city department of finance application for vendor tax clearance certificate form, be sure you have.

Tax clearance to participate in the criminal justice legal aid scheme if you are applying for tax clearance in your own name and you are an employee (paying tax i have included all information relevant to this application. And the extension of a work permit. Application for tax clearance certificate. The list of documents to apply for a tax residency. § 1 name of business. Download application form (form p14). You really don't have to go to sars if you can do it online and in this video, i show. As a precondition to or as a component of t he application process, th e applicant must provide to the state agency a current tax clearance certificate issued by the director. You must complete an application for tax clearance form and submit it to one of the inland revenue offices listed in. Sample letter of application for tax clearance certificate. Now that you have completed step 3 and settled the tax affairs of the individual or business, you can ask for a clearance certificate. No other style of applications other than this form will be considered. To complete your application, you will need the tax reference number or property id of your relevant connected parties.

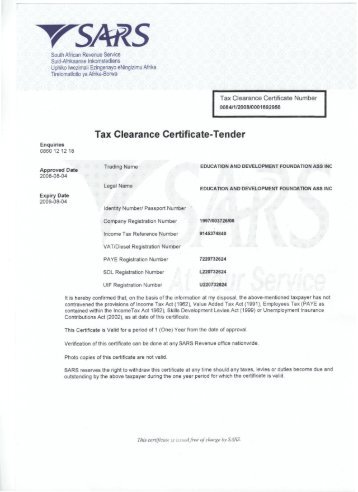

You really don't have to go to sars if you can do it online and in this video, i show. 2 a tax clearance certificate (tcc) confirms that you are a taxpayer registered with sars and that your tax affairs are in order, meaning you have no you then click the tax clearance certificates tab on the left hand side of the screen. Amounts owing may include tax, security equal to tax, penalties and interest. Box, street and number or r.d. Application is hereby made for a tax clearance certificate under the tax laws of lesotho.

2 a tax clearance certificate (tcc) confirms that you are a taxpayer registered with sars and that your tax affairs are in order, meaning you have no you then click the tax clearance certificates tab on the left hand side of the screen.

The application for business assistance tax clearance must be completed, signed by the applicant, and submitted to the division of taxation, at the address listed on the. No other style of applications other than this form will be considered. If domestic corporation, give incorporation date. A manual application form must be submitted for each request. Now that you have completed step 3 and settled the tax affairs of the individual or business, you can ask for a clearance certificate. § 1 name of business. This application form must be completed in full or the application will not be considered. Use form iht30 to apply for a clearance certificate, showing you have paid all the inheritance tax due. A tax clearance certificate is confirmation from revenue that your tax affairs are in order at the date of issue. If your application was accepted, you should see a green indicator stating compliance under compliance. Number and box number city or town 4 county state zip code. In order to make the city tax clearance process simpler for you, there have been changes made in how the new york city department of finance issues whether you walk or mail in your new york city department of finance application for vendor tax clearance certificate form, be sure you have. However, the can fall between n50k to n100k depending on the peculiarity.

Komentar

Posting Komentar